My old grandmother is the smartest of all in my home, a few months back her pension account got accumulated a year full of savings to one lakh. She asked that money be withdrawn put in a bank deposit account and share that money between the brothers after 5 years one lakh each.

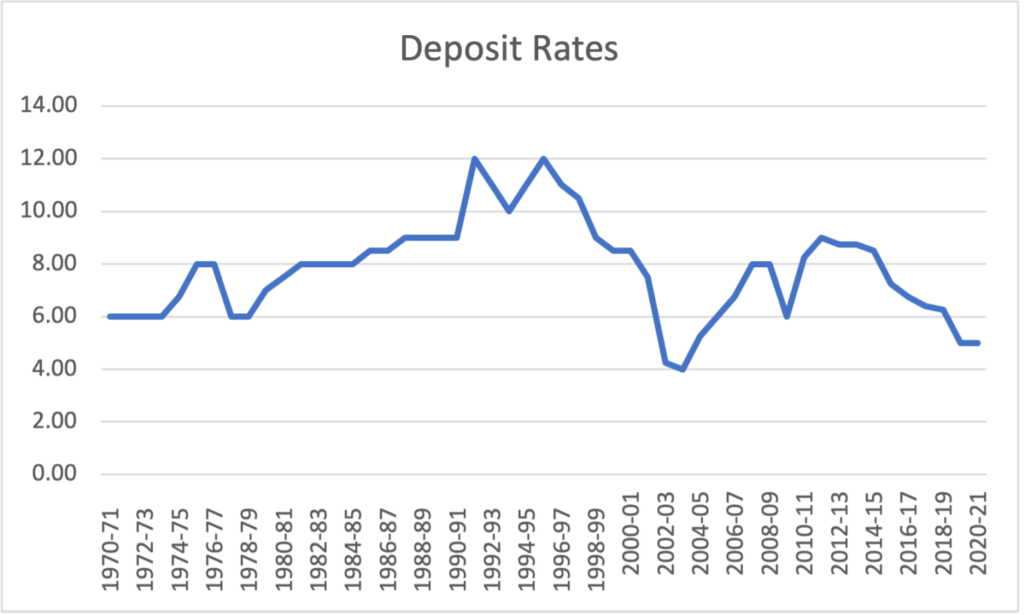

My poor grandmother having grown older by 90 years having known that past chief ministers of Tamil Nadu – Dr. MGR, Dr. Karunanidhi and Ms. Jayalalitha have all passed away but she stopped living in 1990. Bank interest rates have gotten lesser from 12% from 1990 and now it is ~5% only.

Bank Deposit Rates

How did I say she stopped living in 1990? And that was the year roughly interest rates was 12%.

You can calculate number of years to double, given the rate of interest is available or vice versa you can calculate rate of interest if number of years to double is given – using rule of 72.

No. of years to double = 72 / Rate of Return. (or)

Rate of Return = 72 / No. of years to double.

Mutual Fund Investing

I started saving from year 2012 in mutual funds, I bought my first bike with 50% from savings and remaining on EMI. And then started saving for post graduate education. And towards a backup money to start a business.

After 7+ years of working when I decided to start entrepreneurial journey, the savings did help in times when required.

Here are 3 things I want to share:

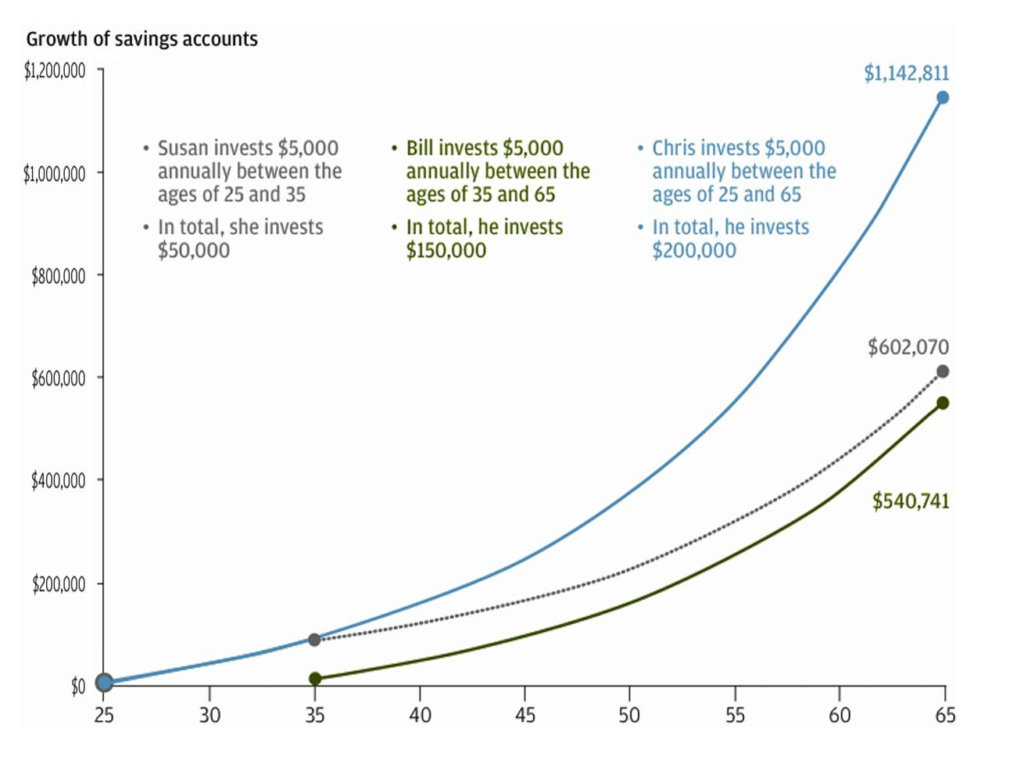

1. One habit to develop – Start saving early

2. Habits to overcome – Should control doing these 5 things

3. Grow smarter

Things that should be avoided in Money & Savings

Mutual Funds in India

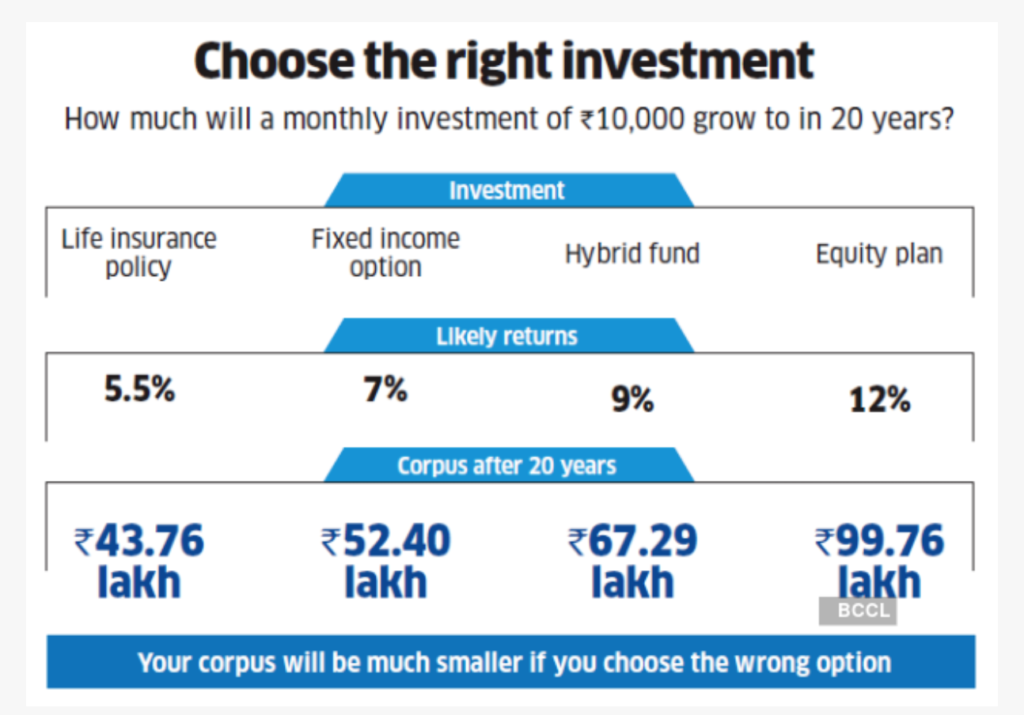

Comparison with Mutual Funds Investing